TLDR

This is an essay as it covers a large amount of intense work over a 30 day period and how we validated our startup! It’s more been written to give a detailed insight to those who were across the work I was doing about what we did, and the measured way we came to our conclusion to not continue with Fledged. If you can’t be bothered reading all this, here’s a TLDR:

- Decided not to continue working on Fledged, an investment fund that parents set up for their children

- I was at the point of needing to spend a lot of money on regulatory costs, but we had no market validation to indicate what we were doing was worthwhile and solving a genuine need due to no marketing and validation metrics

- Had a messy breakup with our marketing co-founder. After 4 months of outreach/work here, we had 8 followers and 70 waitlist signups that consisted primarily of friends and family. We had spoken to almost no customers, had no validation, no path to get there so unfortunately we decided to go our separate ways and work out how to make up for lost time

- Post break up, the rest of us put together a validation plan for a new brand and and executed on each step to collate real data to help make decisions based on fully understanding our end users

- Main findings was whilst this could still work, a parents core need wasn’t an investment fund it was either financial literacy for their family or general investing for themselves, not the intersection in the middle we were working on (although nice to have)

- Learnt a lot

Fledged Recap

Fledged was an investment platform that helped parents set up investment funds for their children. To get a full overview on what we were looking to achieve you can check out this post here.

We inittially started this journey with 4 people under a different brand.

- Myself – Looking after pragmatic product development, regulatory and the financials

- Tech Co-Founder – One of the best engineers and just general problem solver who I was lucky enough to meet through a good friend

- Marketing Co-Founder – Arguably our most important role as we were essentially a marketing business. Getting us in front of customers to shape our product and validate our business

- Designer – Lucky enough to have worked along side this UX/UI powerhouse during my GradConnection days and many other projects since then.

Our Business hadn’t been properly validated

Setting up a managed investment fund carries a lot of cost – 6 figure setup fees and then into multi year contracts with hefty 5 figure monthly minimums so you have to be bloody sure that this commitment is worth it. The first year alone was going to cost us $350,000 in regulatory and that’s not even touching marketing, staff and infra costs.

We were in a bad spot and falling into a common start up trap of potentially building something people didn’t want:

- Financials, Regulatory and Fund Administration had been solved

- Product prototyping complete and build started

- Some initial investment interest

- Parent outreach and interest was non existent. After 4 months, we had 8 facebook followers and a waitlist of 70, consisting mainly of friends and family with very limited to no genuine potential customers.

I was being asked to pay large regulatory costs by our marketing co-founder and at this point I wasn’t comfortable investing myself, let alone trying to take on investors money based on the above results. We’d had some tough conversations about these results and how to move forward, including myself also taking on the outreach responsibilities in return for more equity but unfortunately that approach soured the relationship even further.

We couldn’t come to a resolution about our position with product validation and we were a the point of locking in company documents like shareholders agreements etc so the 3 of us made the tough decision and decided to go our separate ways with our marketing co-founder early. We paused work on product design and build (which was unfortunately coming to an end before validation) until we knew if we were solving the primary pain points for parents to make a go / no go decision.

Whilst I did end up getting lawyered over this, we pushed on regardless in parallel under a different brand name “Fledged” so we didn’t waste any more time. We’d deal with the legal drama later if we thought it was worth the effort once we had spent a lot more time with our potential customers.

Our rapid path to validation

With such large costs, our new goal was to be sure we were building something that people genuinely love and would genuinely be unhappy if we took it away – nothing less.

We got to work and put together a plan for rapidly executing on validating the business, putting some data behind our decisions as well as enhancing our general understanding of our customers.

Validating a business, idea or feature shouldn’t be too difficult (or costly beyond time), it’s essentially just a plan and methodically executing and measuring along the way.

- Have a sound hypothesis around what your customers need, why they need it and how you can solve it.

- Have well defined success metrics and goals to aim for – our hard figure was waitlist numbers

- Make a plan to hit your goals and just get out there and do what you said (you can check ours out below)

- Talk to as many customers as possible

- Measure and listen

- Make a well informed decision to go ahead, abort, or pivot based on the findings.

We gave ourselves a waitlist target and 30 days to make up lost ground on the marketing and outreach front and see what was really out there.

Executing our 30 day validation plan

This was actually a hugely fun process and the below consisted of what we were executing on from our marketing and validation plan and will hopefully take a similar approach when validating future business ideas. Here’s everything we packed into a 30 day period.

- Brand and Collateral – Don’t spend more time than you need to here!

The day we decided to split off and form the new brand Fledged we got to work straight away. In 2 days we had chosen a name (Fledged – when a bird is just mature enough to leave the nest for the first time) and hammered out the following:- Conceptualised and built a new brand off stock photos and templates

- Launched a new marketing site with a viral loops waitlist

- Built a custom wordpress lead generation compound interest for kids calculator

- Built our social media presence as well as all templated collateral go with it

- Measure, Measure, Measure – If you’re not measuring you’re guessing!

With measurement being the cornerstone of what we were doing we set up a basic (but effective) marketing funnel to track acquisition sources, events, conversion and a number of other things:- Viral Loops Waitlist (Our main target forming our go / no go decision)

- Google Analytics, Events and Conversion data

- Basic 3rd party tags for proper attribution

- Basic framework to collate social media comments in a quantitative way

- Bitly / UTM tagging format to track partnership effectiveness etc.

- Guerilla Marketing– Gaining genuine insight from genuine customers

This was going to form the core of our marketing, not only because it was hyper relevant but also because it was free. Roping in friends, dummy accounts and seeding new Reddit profiles got us sneaking into where we needed.

We identified 400 hyper relevant groups to parents across Australia with a combined member base of 1.4M and joined almost every single one under a selection of accounts!

Every single post we put up, we collated/recorded all engagement as well as responses so we could aggregate what parents were currently doing and why to form some hard data to help us.- Below were the main channels we spent the bulk of our focus.

- Parents Groups – Between my wife (to get into Mum’s groups) and a good friend who I had previously built Betistics with we infiltrated hundred’s of parents groups, from Newcastle Dads through to Brunswick Mums

- Community Groups – Many suburbs and regions across Australia have their own community groups that are teaming with families – obviously we got in there as well!

- Sub-reddits – Online communities for Financial Independence, the FIRE movement here in AU and investing were hyper relevant to what we were exploring. We had automated google alerts set up to alert us to anything with (“kids” or “children”) AND “investing”.

- Because of how closed and moderated these channels were we had to post carefully in order to slip past the moderators:

- Sneaky Posting – Pretending to be parents asking for advice. A well curated question around how to invest for my child, a summary of my research (which included links to Fledged) drove extremely high engagement with many parents explaining how they invest for their children and why.

- Sneak Factor – 100% of posts were approved by Admins or not removed resulting in 0 bans.

- Engagement – Extremely high – on average 25+ relevant comments per post.

- Value – Extremely High – Many parents went into great detail about what they have in place if anything and the reasonings behind it which we went on to record, collate and aggregate. Drove a moderate amount of traffic to the website

- Conversion – Moderate. It wasn’t the floodgates we expected but as soon as we started this signups did start flowing through regularly.

- Sneaky Posting – Pretending to be parents asking for advice. A well curated question around how to invest for my child, a summary of my research (which included links to Fledged) drove extremely high engagement with many parents explaining how they invest for their children and why.

- Super Sneaky Posting – We posted job adverts for admin/research roles at Fledged, with a one line spiel on what we did. This came across as offering value to the communities as well as being a one line pitch in disguise which drove a lot of traffic. This drove a large amount of traffic, as well as applicants from interested parents but very low conversion.

We were actually going to hire someone for this part time role to help us in channel research so I could definitely sleep at night.

- Sneak Factor – 90% of posts were accepted in groups. Some moderators removed posts as job ads weren’t allowed or didn’t approve them.

- Engagement – Low. There were a few tags of people alerting their friends which helped but nothing like being on topic.

- Value – Moderate. A large amount of traffic and awareness came from this and a one line pitch made this worthwhile.

- Conversion – Low. Despite huge traffic conversion from this, conversion wasn’t high as visitors were coming with a different end goal of checking out a part time job suitable for parents.

- Direct Posting – Being direct about the new service we were building.

- Sneak Factor – 0%. No sneaking required. This approach resulted in some bans due to business advertising rules and posts being deleted regardless that we thought it was still relevant to the group.

- Engagement – High until the post got locked and removed in some cases.

- Value – There was genuine interest with many parents asking questions or sharing what they are currently doing. Other more specialised and financially savvy communities were pretty brutal and direct with their feedback which was collated and aggregated as well which provided to be very helpful.

- Conversion – Moderate

- Opportunistic Posting – We had google alerts set up on online communities to alert us whenever there was anything children and investment related. This allowed us to jump in to a conversation organically

- Sneak Factor – 100%. As it was on an original legitimate post, we had no issues regardless of what angle we took.

- Engagement – Moderate. We had really strong conversations with parents but only a handful at a time due to being buried in the comments

- Value – Extremely high as the conversations went very in depth which was helpful for understanding our customers

- Conversion – Low mainly due to be buried deeply in the comments of the original post or thread.

- Below were the main channels we spent the bulk of our focus.

- Partnerships

We launched 10 partnerships across Australia with monetised parent focussed parents groups. These sponsorships ranged anywhere from $100 through to 4 figure sums for more comprehensive coverage. Very surprised at how organised some of these communities were.

These communities drove 40% of our waitlist signups and whilst there was a mixed set of results for each community it was worth the effort to try multiple channels out. - Direct Channels / Paid Ads

As we were limited on time, we were shooting from the hip and keen to get anything we could up and running. Paid channels were great to not only test CaC costs but also with tools like google ads it allowed us to narrow down what search terms were performing, what themes were working well along with search volumes and who else was bidding against us.

We ran A/B testing with both text and collateral across the following platforms and as expected we were running up to $40 CaC across these channels which wasn’t great.

- TikTok / Reels

- Customer Experience – Survey Monkey

We built an automated customer onboarding journey for parents signing up on our waitlist that would take them from 0 – 100 for investing. This was primarily a keep warm and engagement strategy to ensure we were in the best spot to convert users from our waitlist through to investors. 1 email a week was what we send and took them through a journey with the end goal being comfortable to invest their first $.

A well crafted onboarding journey resulted in high engagement with a 70% open rate on communications as well as multiple parents filling out in-depth 10 minute survey’s and following us on our social channels and joining community groups to discuss investing. In the end we had about 120 in depth survey’s providing some mega insight from structured questions as well as free text fields.

What we found out

If you ask any parent – “Is investing for your children a good idea” and of course almost everyone is going to say it’s a good idea without really thinking about it. Who doesn’t want the best for their children and investing is a good thing right? Confirmation bias was a real thing here.

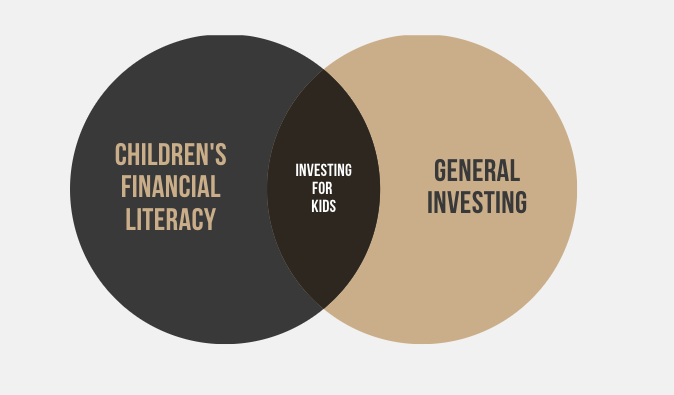

After collating thousands of data points from all the channels above over an epic 30 days, we were beginning to face the harsh reality that we weren’t nailing some of the core customer needs but more an intersection of two primary needs:

[Primary Need] Children’s Financial Literacy

Teach your children how to fish and they’ll be fine for the rest of their lives.

The major concern that far outweighed leaving a nest egg for their children was teaching children how to manage money and was the number one concern for parents, regardless if they knew how to do this or not. Many parents were employing a number of methods from the barefoot investor through to apps like Spriggy (a clear winner) and Revolut.

[Primary Need] General Investing

On a plane – they say put on your mask before helping others. Many parents had this view point when it came to helping their children financially.

One camp of parents were already investing for themselves and didn’t necessarily want or need a separate account for the child. The way they saw it was with good financial and investing habits and by personally being in the best shape financially it would put them in the best position to help their children. They were utilising platforms like Commsec, Stake, Pearler, Selfwealth, Superhero or things like investment bonds to invest for themselves (and sometimes their children) and not having to pay the management fees we would have to charge to run a custodial model. When the financially savvy looked at our offering and they could be quite brutal on feedback, particularly around fees. For example, we charged 0.79% per annum but by buying the ETF directly you could cut that down to about 0.1%

The other camps of parents were those who weren’t yet investing and came to us to learn. Long story short, as soon as we taught them, they would start to fall into the financially savvy camp and had a high potential to leave us and start investing directly for themselves and their children across more assets than Fledged was able to offer using a variety of options being used below:

[Secondary Need] Investing for kids

All our data points were indicating we had missed the core needs of our users and were trying to start in between the 2. It made more sense to start on either side of the Venn and branch into investing for kids as a value add and that’s exactly what we were seeing in the market.

Spriggy invest was in the process of launching as a value add to a sound financial literacy offering, Commsec, Superhero and Pearler had just launched minors trust accounts allowing parents to consolidate everything in a single platform indicating that this was the approach many who were solving core needs were taking.

How parents were currently investing for their children

Across hundreds of comments from parents nationwide, parents who were already financially literate and investing to some degree were using or recommending a number of other platforms which was more than we thought:

- 18.7% – Investment bonds

- 17.7% – Bank Accounts (Savings & mortgage offsets)

- 16.9% – Raiz Kids

- 14.2% – New Age Brokers (Pearler, Selfwealth, Stake, Superhero etc.)

- 10.7% – Traditional Brokers

- 8% – Spaceship

- 6.2% – Commsec Pocket

- 4% – Stockspot

- 3.6% – Vanguard Personal Investor

Next Steps

Whilst we had an epic 30 days and also almost quadrupled legtimate signups in this short time, we didn’t hit our waitlist targets that we set which was a major factor in choosing to wrap things up but our learnings about what parents were actually looking for in their primary needs was the real eye opener for me.

There might have been a business here but it wouldn’t have been a business that won by providing the best product that solves a parents core needs when it comes to their children’s financial future.

At this point we decided to stop working on Fledged.

We’ll be looking forward to the team continuing to work together and tackle the next problem to solve and excited to go through a similar validation process right off the bat.

If anyone wants to chat to me about any aspects of this journey or industry, just get in touch!

Lessons Learnt

- Validation and distribution channels should be the main focus. If you haven’t dug into what your customers really need you run risk of building the wrong product. We almost did that here and at a huge financial cost for this specific business

- Offer value from day one. Despite having no product live, people were taking the time to engage with us. Our compound interest calculator for kids provided value right away and we were enjoying 80c CPC with high engagement. Also providing research into where parents could currently invest got them buying into our guerilla marketing conversations with people readily taking time to share their own knowledge or find out more.

- Make tough decisions quickly and early – At the time, the conflict with our marketing co-founder was tough, but after reflecting over the last couple of months it was the definitely the best decision. If things had continued as they were I would have burnt even more months of personal runway, potentially be down 6 figures in regulatory and build costs as well as not moving the business where we needed to in regards to reaching our potential customers. If we had left this decisicion too long, it would have been tougher to sort out, especially if the business had made more progress over that time.

- Don’t let perfection get in the way of progress – There is no perfect way to start something, so just start getting things out there and shooting from the hip and things will start to fall into place. Our new plan was less than perfect but built momentum as we went and the most important thing was just starting. Even though this didn’t work out the way we wanted, I’m amazed at the long lasting connections this action oriented approach has created.

- Appreciate the good people in your life – I had good friends help me hit community groups and talk to parents all over Australia, friends let their son Archie be the face of Fledged, friends from the product team at my old company GradConnection helping me build some ad-hoc things, mentors / potential investors spend their time to help with good decisions as well as making new connections that have resulted in potential work opportunities and some i’m even investing with now. I look forward to working with all of them again in the future more than they know!